Trusts made a rare appearance in the press the other day, in the context of an amendment to the rules on Additional Buyers’ Stamp Duty (“ABSD”).

The Straits Times on 10 May reported that “[c]ash rich buyers who have been circumventing [ABSD] regulations by making residential property purchases via trusts that are conditional or revocable may no longer be able to use that loophole.”

The use of the word “may” suggests a degree of ambivalence or uncertainty about the new rules. Actually there is no real uncertainty. And there is one actual certainty: cash-rich buyers are likely to be one category of purchaser who will not necessarily be deterred from utilizing valid and enforceable trusts.

The IRAS website sets out the situation clearly enough.

“On 8 May 2022, the Government announced that ABSD of 35 % will apply on any transfer of residential property under a living trust i.e. a trust that is created by a person during his or her lifetime, with effect from 9 May 2022. This will be known as ABSD (Trust).”

“ABSD (Trust) is payable upfront but in appropriate circumstances a remittance will be paid by IRAS.”

The real interest in this story is what are the circumstances in which a remittance applies. This is why cash-rich buyers who are well advised will not necessarily be deterred from proceeding with their purchases by utilising a trust.

The answer to that question is provided by the Stamp Duties (Trusts for Identifiable Individual Beneficiary) (Remission of ABSD) Rules 2022 (the “Rules”).

The Rules provide that a refund may be available if the trust in question is for the benefit of an “identifiable individual beneficiary” or beneficiaries. If that is the case, the question of whether a refund is available will depend on the “residential property count” of that beneficiary. So the position may not actually change; if the beneficiary owns no residential property, he only difference from the position before the implementation of the Rules will be the upfront payment.

There are some aspects to the new position that are worth considering.

First, a preliminary point about “living trusts“. There are all sorts of categories of trust – express, implied, fixed, discretionary, etc – but essentially a trust can only be created in one of two ways. It is either created by a living settlor, (a “living trust” or an inter vivos trust) or it is created by a settlor in his or her will and comes into effect on his or her death (a “will trust”). Wills are not subject to stamp duty ; leaving aside the issue of stamp duty payable on the purchase, the creation of an inter vivos trust will itself be a stampable event as a trust relating to land has to be evidenced in writing.

The critical issue in the Rules is the need for an “identifiable, individual beneficiary “or beneficiaries if a remittance is to be sought. On the face of it this seems strange because it is not possible for a private trust to be valid under Singapore law in the first place unless it is for the benefit of an identifiable, individual beneficiary or beneficiaries.

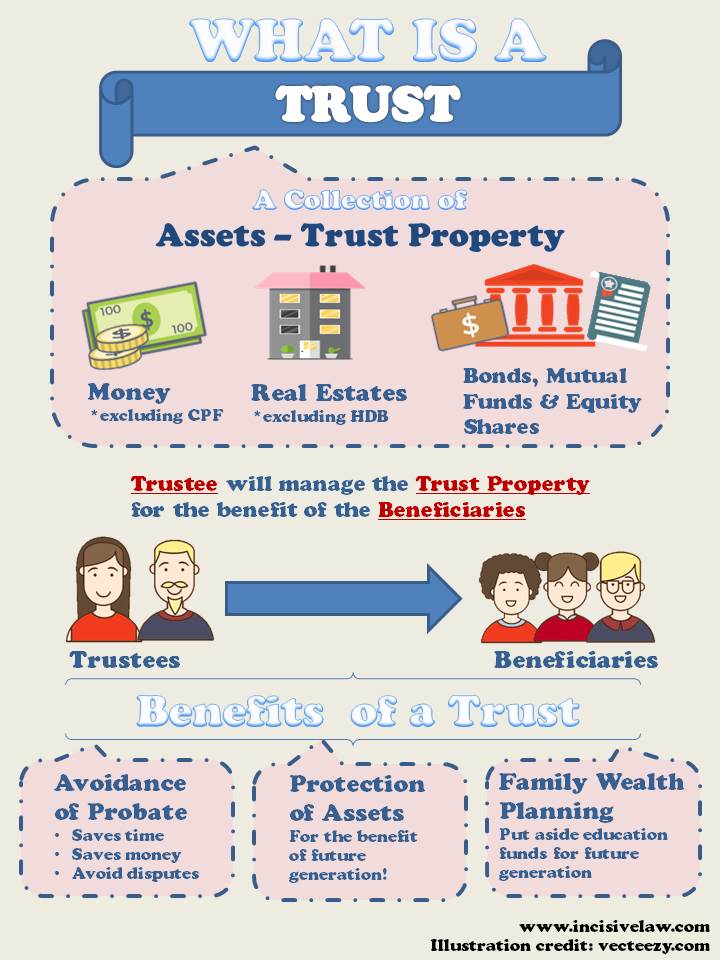

A trust is not a thing. It is a relationship between a trustee or trustees and a beneficiary or beneficiaries. The trustee owns and manages the trust property on behalf of the beneficiary. In the case of a private trust there has to be an identifiable beneficiary or beneficiaries. This is the effect of the so-called beneficiary principle. A trust without a beneficiary will be unenforceable against the trustee, and it will be void. Public, charitable trusts are different. A trust for a charitable purpose is valid, as long as it ticks the legal boxes for being charitable; it will be enforceable by the Attorney-General, (and of course regulated by the Commissioner for Charities).

Under Singapore law, it is not possible to have a private trust for a purpose, as opposed to a beneficiary, subject to minor irrelevant exceptions. But other, offshore, jurisdictions have taken a different view. In places like the Channel Islands purpose trusts are perfectly acceptable. It seems highly unlikely, however, that a purchaser of residential property in Singapore would utilize a trust that was demonstrably ineffective as a matter of Singapore law.

Enlightenment is to be found in the definition of “identifiable, individual beneficiary” in Article 3 of the First Schedule to the Stamp Duties Act 1929. Such an individual is “an individual who, because of the trust, has beneficial ownership of the estate or interest (whether solely or together with another) that is not, under the terms of the trust, revocable, variable, or subject to any condition subsequent, but excludes an individual who is entitled to any estate or interest in property in remainder or reversion.” (Paragraph (1A) (b)). (Emphasis added.)

Three categories of individual are expressly excluded from the definition of “identifiable individual beneficiary” under Paragraph (1B): an individual who is not born on the date of the declaration of trust, an individual who is entitled only to income, and an individual whose estate or interest is a contingent or discretionary one or who becomes entitled to an estate or interest only upon revocation of the trust.

The interesting thing here is that each of the categories of person who does not qualify as an identifiable individual beneficiary in respect of whom a remittance can be sought is, as a matter of fact and law an identifiable individual beneficiary. The best example is a beneficiary under a discretionary trust. Discretionary trusts are popular because they enable the trustee to make decisions about the deployment of trust assets based on the changing needs and fortunes of individual beneficiaries. There is a “class” of beneficiaries. It could be a big class – all the employees of a major company – or it could be a small one – all the children and grandchildren of the settlor, in each case in such proportions as the trustee shall determine. This is very different from a fixed trust – “to the grandchildren of X in equal shares”. In the case of a discretionary trust, no beneficiary has an interest in the trust property unless and until a distribution is made to him or her by the trustee.

It can immediately be seen that there are several references to discretionary trusts in the definition quoted above. But it is equally clear that a beneficiary under a discretionary trust is an “identifiable individual beneficiary”. All trusts have to satisfy a test for “certainty of objects”, so that there is no doubt about who the beneficiaries are. In the case of discretionary trusts the test is that it must be possible to say of any given individual whether he or she is or is not a member of the class.

By definition then a beneficiary under a discretionary trust is an identifiable individual. But there are strong public policy reasons why a discretionary trust should be excluded from provisions relating to remittance of ABSD. The most obvious point is that the settlor himself can be a beneficiary. A discretionary trust could certainly be used to circumvent the policy objectives of the ABSD regulations.

The same is true of the other exceptions, though they may be more obscure than discretionary trusts. A purist might question if a revocable trust is actually valid. They are not uncommon, predictably, in offshore jurisdictions and the trusts industry in Singapore seems to have accepted them. Such a trust, however, would clearly again make nonsense of the ABSD regulations. On revocation the trust property would revert to the settler. The same is true of the rarified notion of a trust subject to a condition subsequent. For now there is an identifiable individual beneficiary. But if the condition is breached the property reverts to the settlor. Trusts subject to a contingency, or future trusts where the property is held in remainder or reversion are perfectly valid, subject to the rule against perpetuities, but there are questions about the location of the beneficial interest in the meantime.

In short, the impact of the Rules is that the new ABSD regulations relating to trusts should not deter potential purchasers who want to employ what you might call plain vanilla trusts to capitalize on the fact that the intended beneficiary owns no residential property.

There are only two downsides. One is the upfront payment but that is not going to deter the genuinely cash-rich purchaser.

The other is that once the beneficiary (ies) Is (are) 21 years old or over and fully legally capable, he, she or they can call for the trust to be terminated and for the legal estate in the property to be transferred to him/ her / them. This needs to be borne in mind by any purchaser thinking of using his or her child or children as nominee beneficiaries.